The Growing Potential of QR Codes in Instant Payments

The Growing Potential of QR Codes in Instant Payments

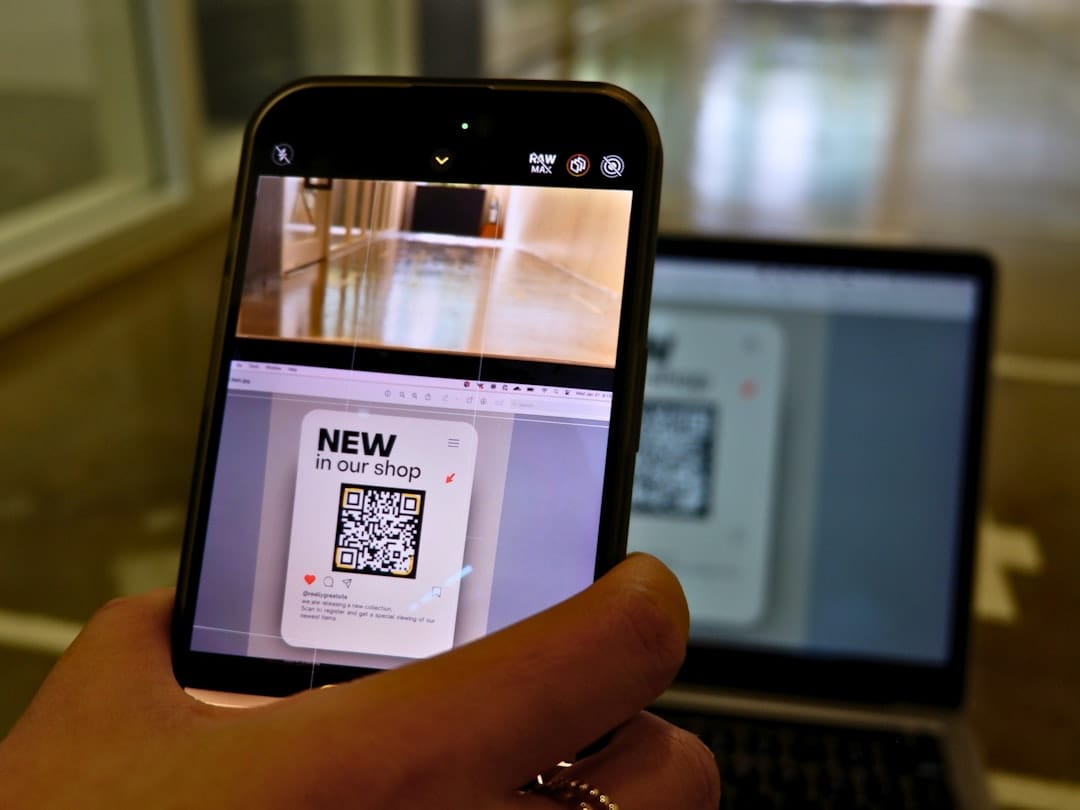

QR codes are becoming a prominent feature in retail environments, transforming how transactions are conducted. These square barcodes, which can be scanned using a smartphone, offer a convenient and contactless payment option. Although the adoption of QR codes is more widespread internationally, they are gradually gaining traction in the United States. Let's explore how QR codes work, the hurdles they face, and the risks associated with their use.

Understanding QR Code Payments

QR codes, short for Quick Response codes, function as a type of barcode that is easily readable by digital devices. Developed in the 1990s, they experienced a resurgence during the pandemic as a touch-free method to access information, such as digital menus or business details. Now, these codes are being utilized for payments, offering an alternative to traditional card payments.

In the merchant-presented model, commonly used in the U.S., businesses display a QR code that customers can scan with payment apps like PayPal, Venmo, or directly through a smartphone camera. The code contains essential transaction details such as the account, amount, and order number. Once the customer confirms the payment, funds are transferred swiftly through existing payment networks.

The Appeal to Small Vendors

QR codes are particularly attractive to small vendors who seek cost-effective checkout solutions. Unlike traditional point-of-sale systems that require investment in card readers and other equipment, QR codes can be printed or displayed on a screen, enabling businesses to accept payments with minimal hardware—essentially just a smartphone camera.

QR Code Adoption in the U.S.

Despite their benefits, QR codes face challenges in the U.S. market. Many American consumers are accustomed to using cards or digital wallets linked to cards, which have been deeply integrated into the payment infrastructure. Near-field communication (NFC) technology, which facilitates contactless payments, offers a seamless experience by simply tapping a card or device.

However, QR codes offer advantages in terms of flexibility and cost. They do not require special terminals and can be employed in varied settings, making them ideal for pop-up shops or temporary market stalls. As more retailers experiment with QR codes, their popularity is likely to increase.

The Need for a Unified QR Code Standard

One significant obstacle to widespread adoption is the lack of a unified QR code standard. Currently, different payment apps and platforms may require different QR code setups, which can be cumbersome for both merchants and consumers. Efforts are underway to develop a universal standard that would allow any app to read any QR code, streamlining the payment process.

The Federal Reserve has even tested a uniform QR code standard with its instant payment service, FedNow, which could pave the way for broader adoption if implemented.

Ensuring Security and Minimizing Fraud

As with any digital payment method, QR codes come with risks, particularly fraud. One common scam, known as "quishing," involves criminals replacing legitimate QR codes with fake ones to redirect payments or steal personal information. To mitigate this, industry experts advocate for the use of dynamic QR codes that refresh with each transaction, incorporating unique details that make them harder to tamper with.

Consumers should remain vigilant by only scanning QR codes from trusted sources and verifying the URLs to ensure they are legitimate before proceeding with any transactions.

The Future of QR Code Payments

QR codes hold significant promise for the future of payments, particularly as efforts to standardize and secure the technology advance. By reducing costs and increasing flexibility, QR codes offer a compelling option for both small vendors and large retailers aiming to enhance the checkout experience.

As more consumers and businesses recognize the benefits of QR codes, their role in reshaping payment habits could continue to grow, making it an exciting development in the financial technology landscape.

If you're interested in creating your own QR codes for payment or other purposes, consider using a reliable QR code generator to get started.