Protecting Yourself from QR Code and NFC Hacks: A Rising Threat

Protecting Yourself from QR Code and NFC Hacks: A Rising Threat

In recent months, cybercriminals in Korea have unleashed sophisticated techniques that exploit seemingly innocuous technologies like QR codes and NFC payments, leading to significant financial losses for victims. As these hacking methods become more advanced, it's crucial to understand their mechanisms and take preventive measures to safeguard personal information and finances.

Recent Hacking Incidents

One noteworthy case involved an individual, referred to as Mr. A, who discovered that 52 million Korean won had been illegally withdrawn from his bank accounts via a mobile banking app. The perpetrators had stolen Mr. A's personal information, created fake identities, and executed multiple fraudulent transactions.

In another incident, a criminal group exploited NFC technology to siphon off 3 billion Korean won. They managed to steal credit card data through smishing, posing as legitimate merchants, and performing numerous micro-transactions that went largely unnoticed.

Emerging Threats in Digital Transactions

These cases highlight a troubling trend where hackers bypass traditional security measures by targeting communication networks directly. Unlike previous breaches that focused on corporate data theft, these attacks directly harm individuals, leading to severe financial losses that occur even while victims are unaware.

The scale of these breaches is alarming. For instance, telecommunications company KT reported a rise in affected customers and damages due to illegal micro-base stations used by hackers. Similarly, Lotte Card experienced a large-scale data breach, compromising the details of 2.97 million customers, putting them at risk of fraudulent card use.

Exploiting Vulnerabilities in Everyday Technology

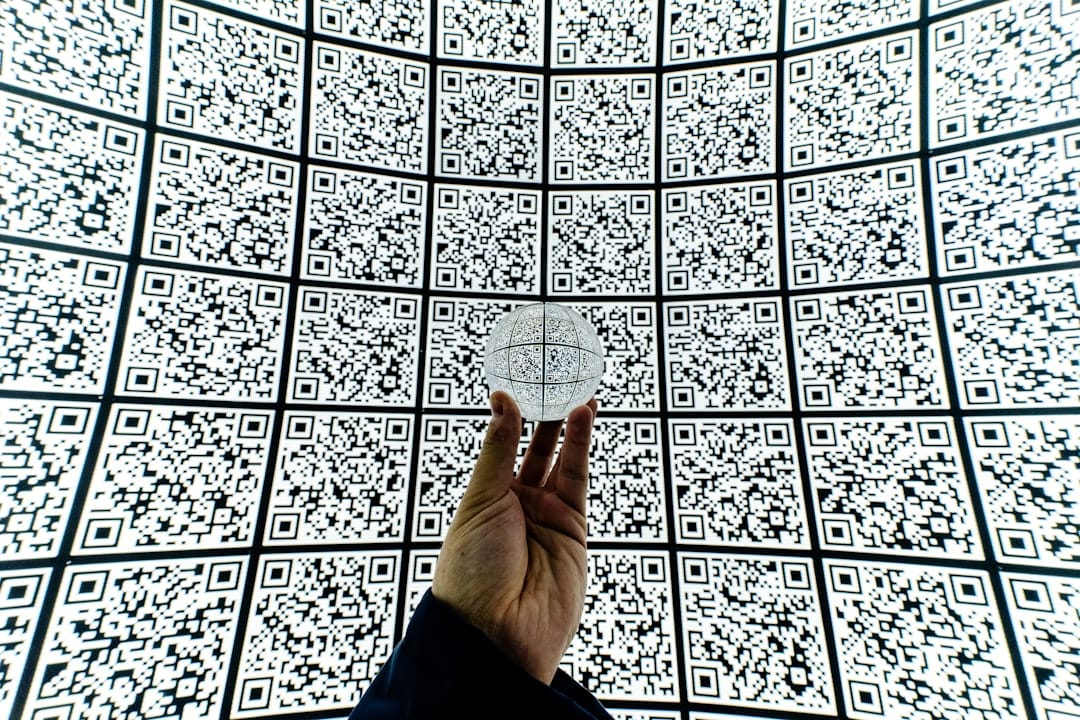

With the rapid evolution of hacking techniques, even simple daily activities like renting a bike can expose users to risks. A recent hacking method, "Qshing," involves replacing legitimate QR codes with malicious ones. When unsuspecting users scan these codes, they are redirected to phishing sites that capture sensitive information.

Public places and advertisements are not immune, as fake QR codes can appear anywhere, leading to potential scams. Moreover, NFC technology used in mobile payments is increasingly targeted. Hackers intercept payment data transmitted wirelessly, enabling them to commit fraud without physical card theft.

Protecting Your Finances

To defend against these sophisticated attacks, consider taking the following precautions:

- Limit Micro-Payments: Adjust your mobile settings to block or limit micro-payments. Contact your service provider for assistance.

- Enable Alerts: Set up real-time notifications for transactions through your banking or card apps. This helps detect unauthorized activities promptly.

- Monitor Accounts Regularly: Regularly check for unauthorized telecom or financial accounts under your name using services like "M-Safer Identity Theft Prevention."

- Check for Unauthorized Charges: Utilize free credit check services to spot unapproved accounts or loans.

- Be Cautious of Phishing Attempts: Remain vigilant against spam messages claiming "micro-payment cancellations" or similar scams.

Additionally, consider disabling overseas transactions if they're unnecessary, as many hacks exploit international payment gateways. Keeping your digital and financial life secure requires constant vigilance and a proactive approach to managing technology.

Government Response and Future Safeguards

In response to these escalating cyber threats, President Lee Jae-myung has called for comprehensive, system-wide security measures to counteract evolving hacking crimes. His administration is pushing for enhanced governmental efforts to address and mitigate hacking damages, emphasizing the need for long-term solutions.

As hacking methods continue to evolve, it's imperative for individuals, businesses, and governments to collaborate on developing robust security protocols. By staying informed and taking proactive measures, we can better protect ourselves from the emerging threats posed by QR codes, NFC payments, and other digital technologies.

The onus is on everyone to adapt to these challenges and ensure that our digital lives remain as secure as possible in this interconnected age. Remember, even something as simple as using a QR code generator requires caution to prevent becoming a victim of these sophisticated scams.