From QR Codes to Facial Recognition: The Evolution of Payment Systems in China

From QR Codes to Facial Recognition: The Evolution of Payment Systems in China

The landscape of digital payments in China has undergone a significant transformation, moving from the once-revolutionary QR code generator payments to state-of-the-art facial recognition systems. This transition marks a pivotal change in how everyday transactions are conducted, driven by major players like Alipay and WeChat Pay. What began as a push towards cashless payments via smartphone apps has now evolved into a system where a simple glance can authorize a purchase.

The Rise of Facial Recognition Payments

Facial recognition technology is not just a technological upgrade; it introduces complex discussions about biometric data privacy and consumer consent. The rapid adoption of Face Pay—from bustling street markets to metro gates—highlights the need for a balance between technological advancement and ethical considerations. This article delves into how China navigates the speed of innovation while ensuring personal information protection.

Key Developments in Facial Recognition Payments

- Launch Year: 2017, marked by Alipay's Smile to Pay debut at a KFC concept store in Hangzhou.

- Technology Backbone: Integration of facial recognition with Alipay and WeChat Pay accounts.

- Primary Sectors: Quick-service restaurants, grocery chains, vending kiosks, and metro systems.

- Regulatory Milestones: Personal Information Protection Law and measures prohibiting forced facial recognition by 2025.

- Adoption Motivation: To reduce checkout friction, enhance speed, and integrate loyalty programs.

Privacy Safeguards

The implementation of facial recognition payments includes core protections, such as requiring consent prior to enrollment, clear signage indicating active facial recognition, and providing alternative payment methods.

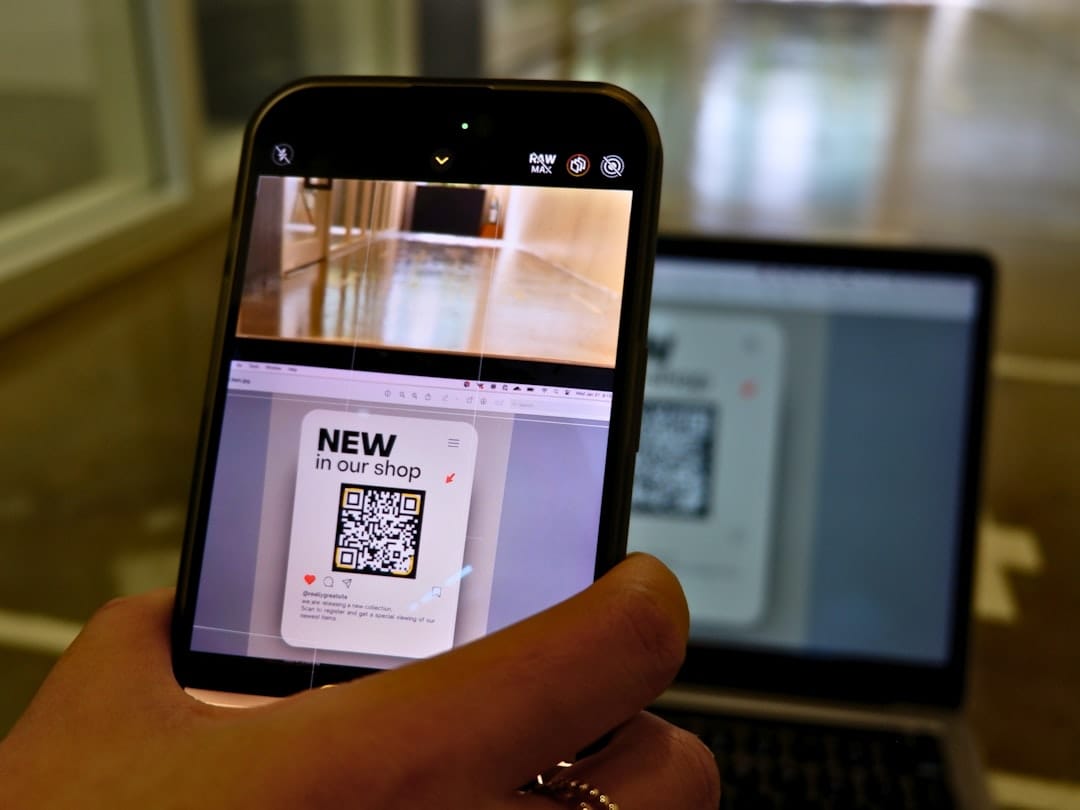

The Precursor: QR Code Payments

Before the advent of facial recognition, QR code payments had already transformed the payment landscape in China. By the mid-2010s, scanning a QR code was second nature for millions. The People’s Bank of China ensured these solutions were accessible to a wide range of vendors, from high-end retailers to small food stalls.

The simplicity of QR code payments was revolutionary. Vendors could easily print a QR code linked to an Alipay or WeChat Pay account, enabling digital payments without the need for sophisticated hardware. This democratized cashless transactions, allowing small merchants to participate in the digital economy without the burden of setting up card terminals.

Limitations of QR Code Payments

Despite their success, QR code payments were not without shortcomings. They required a smartphone, and inefficiencies such as phone unlocking, app switching, and potential scanning errors in low light added friction to transactions.

The Shift to Facial Recognition

The transition to facial recognition payment systems emerged as a solution to these inefficiencies. By eliminating the need for physical interaction during transactions, Face Pay promised to streamline the checkout process, especially in high-traffic environments like supermarkets and transit systems.

Facial recognition also enabled businesses to connect payments directly to user profiles, offering enhanced marketing insights and opportunities for personalized customer engagement. For consumers, it meant shopping without needing to pull out a phone—an experience that rapidly gained traction in urban centers like Hangzhou and Shenzhen.

Addressing Privacy Concerns

The introduction of biometric payments raised questions about data security. China responded by establishing regulations that classify facial data as sensitive, requiring explicit consent and secure handling. These safeguards are essential as the nation continues to innovate in digital payments.

Implementing Facial Recognition Payments

Enrolling in a facial payment system involves registering one's face through an app like Alipay or WeChat Pay, which creates a template for future authentication. During checkout, a camera captures a live image to verify identity against the stored template. Advanced systems use liveness detection to ensure authenticity, preventing fraud.

Once verified, payments are automatically deducted, eliminating the need for scanning or tapping. This system reduces waiting times for customers and decreases the likelihood of scanning errors. However, merchants must comply with consent requirements and offer alternative payment methods.

Impact on Retail and Public Transit

Facial recognition payments have gained traction in various sectors, including public transit. In cities like Zhengzhou and Guangzhou, metro systems allow passengers to use facial recognition for quick and seamless access. This widespread adoption has normalized the technology, enhancing trust among users.

Challenges and Opportunities for Businesses

For small and medium-sized businesses, adopting Face Pay offers both advantages and challenges. While it simplifies transactions and enhances customer engagement through loyalty programs, it also requires investment in hardware and staff training. Moreover, businesses must ensure customers feel secure about how their biometric data is used.

Despite these hurdles, the long-term benefits of biometric systems, such as increased efficiency and enhanced marketing potential, are appealing to many business owners.

Data Privacy and Regulatory Measures

Each transaction via facial recognition creates a detailed data trail, linking purchases directly to biometric identities. This precision offers opportunities for tailored consumer experiences but raises privacy concerns. Regulations such as the Personal Information Protection Law dictate how such data should be managed, emphasizing transparency and user consent.

The Future of Biometric Payments

China’s swift adoption of Face Pay demonstrates how technological innovations can quickly become integrated into daily life, provided there is infrastructural support and regulatory oversight. While facial recognition payments reduce transaction friction, they highlight the necessity of clear legal frameworks to protect personal autonomy.

The lessons from China’s experience provide a roadmap for other countries considering similar technologies. Key takeaways include the importance of building consent mechanisms, setting robust data retention policies, and offering alternatives to ensure inclusivity.

Ultimately, the success of any biometric payment system lies in its ability to harmonize innovation with privacy, maintaining user trust while enhancing convenience.